By Nikhil Gharekhan, Managing Partner, Presciant

Branding in M&A is rising; driven by that fact that brand can be a significant asset in driving transaction values. Marketers need to be ready with a brand strategy to play an important role.

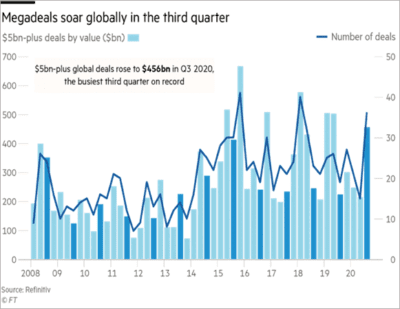

Merger and acquisition activity is rebounding as corporations across the world shrug off their deer-in-the-headlights stance, a symptom of the pandemic and associated global lockdowns. The third quarter saw total transactions worth more than $1 trillion worldwide, representing a dramatic 80% increase from the previous quarter. Megadeals of $5 billion and above reached $456 billion, making the third quarter the busiest on record. This does not look like a backlog-clearing blip. Almost 2/3 of M&A executives at corporations are planning to engage fully in pre-Covid-19 levels of deal-making activity in the next 6-12 months. And all this was happening even before the recent vaccine announcements.

Paradoxically it is the pandemic itself which is driving deal-making. Some corporations are seeing consolidation and scale as a means to better insulate themselves in a post-Covid-19 world. For others, Covid-19 is driving a focus on diversification of product lines and geographies. And of course, on-going trends such as disruption from AI & other technologies, convergence of sectors, lower interest rates have not gone away and will continue to spur additional deals.

Branding in M&A: Why should this M&A activity matter to marketers?

Branding in M&A matters because brands are significant financial assets for corporations, estimated to generate about a third of market value. This brand value, driven by a thoughtful brand strategy, can have a dramatic impact on M&A transactions. Corporate deals, in turn, can have fundamental implications for brands, whether you are acquiring, being acquired, merging, being divested, partnering, going into joint-ventures or are simply witnessing your competitor doing the deal-making. The brand strategy questions brand owners need to address can be truly soul-searching. How should we redefine our brand positioning and what we stand for? How should our company be named? How do we evolve our brand architecture? Do we need a new visual identity? How should we restructure our offering? How do we talk about the new deal to our employees, customers and stakeholders?

Brand strategy can drive a significant swing in value for an M&A deal

Brand issues that are triggered by M&A activity are not only extensive and profound, they can also be truly material to the financial success of the transaction. Recent experience shows that the right brand strategy decision can add more than 23% to the expected post-M&A shareholder value of a corporation, while the value-at-risk from the wrong decision could be as high as 19%. That represents a 42% swing in value, which, for a multi-billion-dollar transaction, certainly should get the attention of CEOs, CFOs and Boards.

M&A should be a time when brand strategy rises to the top of the corporate agenda, given the financial implications at stake. Branding needs to have a seat at the table throughout—at the start, during, as well as after the M&A deal.

Branding in M&A at the start of the process

Brand strategy can play a critical role right from the early phases of the M&A process, when deal objectives are being defined, and potential target companies are being identified.

- Future proofing: As the knowledge source of customer needs and future trends, marketers can help ensure that the acquisition or merger strategy is focused on the long-term.

- Brand valuation: They can establish the financial value of their brand, to safeguard it from being given away during merger discussions.

- Brand options analysis: They can run scenario planning to help determine which acquisition target will create the most brand value.

- Brand licensing: They can help set brand licensing rates during joint-venture and partnership negotiations.

Brand strategy during the M&A process

Once a target or partner company has been identified, or due diligence is in progress, the need for brand strategy becomes even more amplified.

- Brand positioning: Marketers can help define the new company’s purpose to clearly articulate the strategic intent behind the deal.

- Brand creation: They can provide the data-driven voice of reason in the otherwise very emotional discussions of how to name the corporation, product or division.

- Brand architecture: They can define the roles and relationships of the acquired brand versus the corporate brand.

- Brand portfolio: They can take the opportunity to reorganize their brand portfolios to clarify what the new offering will be, with an eye on the future.

After the M&A process

Post-deal, there is still, of course, plenty for marketing to do when it comes to branding in M&A. There are creative platforms to be designed, communications to be deployed, customer experiences to be reshaped, governance systems to be established, and measurement to be conducted.

With the next wave of M&A activity arriving, corporations will be better served by incorporating brand strategy early in the process. Marketers, be ready!

—

Sources: M&A spikes in record third quarter as boards go on pandemic deal spree, Reuters, Sept 2020; The 2020 M&A Report: Alternative Deals Gain Traction, BCG, Sept 2020; M&A Trends Survey: The future of M&A: Deal trends in a changing world, Deloitte, Oct 2020; Deal-making rebound drives busiest summer for M&A on record, Financial Times, Sept 2020

Nikhil Gharekhan is Managing Partner and co-Founder of Presciant, a new brand consultancy dedicated to optimizing ‘brand alpha’: helping companies use brand to gain a financial edge. Before this, Nik was Senior Partner, Global Brand Consulting at Ogilvy for 9 years. Prior to this, he was Managing Director of Millward Brown / Kantar’s consultancy in North America.

For more information, please visit: www.presciant.com